I love commodities.

I love commodities for the simple reason that the “fundamentals” present such a simple story, and an excellent backdrop in forming longer term trading plans. We humans (much like a given species of insect or household pest) are devouring our planet’s resources at breakneck speed and reproducing like flies. We’ve already crunched the numbers on “how much of this is left” and “how much of that” – fully aware that the numbers don’t look good.

Simply put – as we continue to multiply and continue to consume (at ever higher rates) we are going to run out of stuff. Then throw in the extreme changes in weather (likely brought on by our own doing) and you’ve got one hell of an equation for supply and demand. The depleting availability of commodities alone is one thing, coupled with massive population growth and you get the picture.

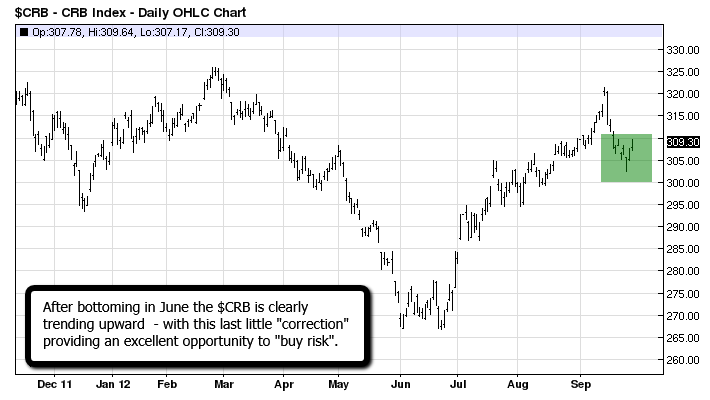

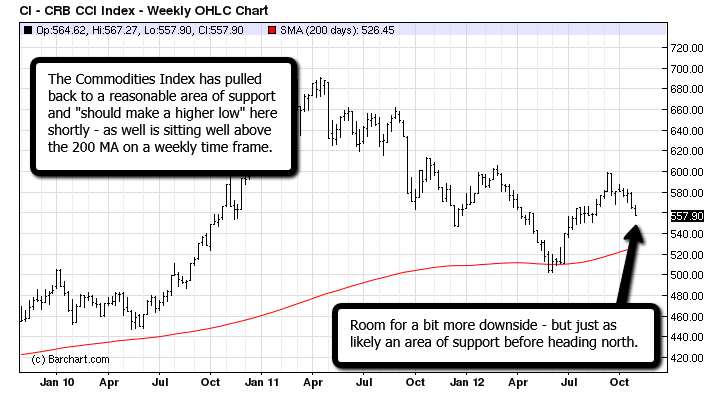

So…..buy commodities and you will be rich. If only it where that easy. Looking at the $CRB (Commodities Index) we can see the turn has more or less just been confirmed.

As I trade currency this generally translates into a lower USD (as commods are priced in dollars) and likely advances made in commodity related currencies such as AUD, NZD and CAD. Others may choose to play it through stocks, futures etc

Regardless – looking at this longer term, and considering the fundamentals behind it – its difficult to envision the price of “stuff” to be going anywhere but up. Way up.