Unlikely to have been mentioned on your local T.V last week, the “real big deal” had little to do with the “circus in Washington” as, quietly behind the scenes The European Central Bank (ECB) and The Peoples Bank Of China (PBC) signed China’s second largest “currency swap agreement” for a wopping 350 billion Chinese Yuan.

In an unpresedented move The European Central Bank said: “The swap arrangement has been established in the context of rapidly growing bilateral trade and investment between the euro area and China, as well as the need to ensure the stability of financial markets.”

In doing so, the parties involved avoid swings in exchange rates. They can also be considerably less reliant on the U.S Dollar for bilateral trade and business deals.

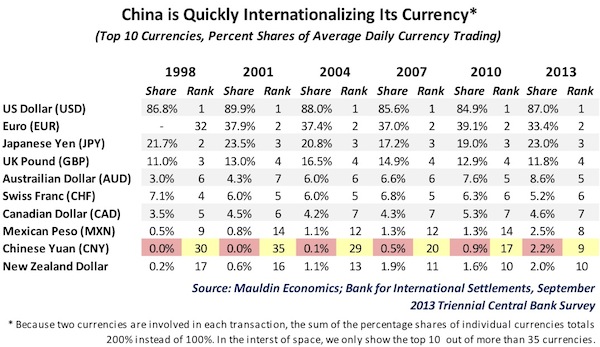

China’s central bank has now signed currency swap deals amounting to some 2.2 trillion yuan with 22 countries and regions, with its continued efforts to internationalize the Yuan and rival the U.S Dollar as the world’s reserve currency.

What do “I” think this deal suggests with respect to the long-term future sustainability of USD, now with Janet Yellen a “shoe in” for continued money printing? Continued money printing???

What do “you think” I think?

Wow. Now EU Zone looking for options moving forward.