These things take time so…let’s just take a minute and re group.

The entire blog / financial community at large is pretty much sitting at a stand still, with a couple of “ridiculous” factors and circumstances in play. Get a load of this….March 15th is not only the DAY the debt ceiling “freeze” does exactly that – but ALSO the day the Fed is widely expected to raise interest rates?? Can you wrap your head around that? Can you?

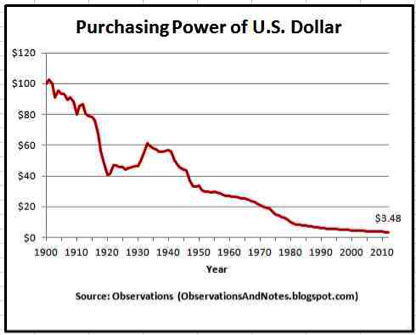

The dichotomy here is unprecedented. I see the debt ceiling biz being completely and totally “blacked out” in the main stream media, as it could very likely lead to government shutdown, as well as some pretty “snappy headlines out there” when the world at large is again reminded….The United States is again 100% flat broke.

I would assume “the powers that be” will keep things lofty moving into the 15th, then regardless of an interest rate hike or not….you’d have to expect our “long-awaited sell off / correction” to start, which will likely take us well past May ( as I also feel that SELL IN MAY will be in effect this year ).

In a broad sense I’d be looking to put some protection in place…start raising cash for a much better time and place to “jump back in”.

There is very likely one more push higher later this year ( and it could very well be a whopper ) so maybe July/Aug would be a great time to grab that cash…..and put it back to use moving into the fall.

EUR longs looking good. NUGT pissing me off.

Forex_Kong